Apple: New High After Blowout

After the bell on Thursday, technology giant Apple (AAPL) reported its fiscal fourth quarter results for the September ending quarter as the stock continues to hit new all-time highs. The company beat handily on the top and bottom line, although there were a few one-time items that contributed to the beats. Guidance also was decent, alleviating short-term concerns about iPhone X production. And with potential changes to the tax policy helping to unlock some of the company's massive international cash hoard, I think this stock can eventually see $200 a share.

First, revenues for the period came in at $52.58 billion, compared to the average street estimate of $50.79 billion, however this included a one-time $640 million favorable adjustment to Service revenues. Gross margins came at 37.91%, towards the higher end of the range, but not over it like we've seen many times before and below street expectations. I'd like to know what gross margins would have been without this accounting change for services, just to get an idea of how they compare to previous quarters. Other income items beat guidance by nearly $300 million, and for the second straight quarter, the tax rate came in much lower than expected. EPS of $2.07, including that 7 cent tax benefit as compared to guidance, beat by 20 cents.

If we look at the main product categories against street expectations, the iPhone was basically where it needed to be or slightly above. However, average selling prices for the device declined by almost $1, implying that iPhone 7 and previous generation phones did a lot better than iPhone 8 devices that included a price raise this year. For the second straight quarter, iPads came in better than expected, and the Mac line did much better than most forecast, including a 25% year-over-year revenue jump. Even excluding the above mentioned adjustment, service revenues beat and so did other products. Then we get to guidance, detailed below:

- Revenue between $84 billion and $87 billion

- Gross margin between 38 percent and 38.5 percent

- Operating expenses between $7.65 billion and $7.75 billion

- Other income/(expense) of $600 million

- Tax rate of 25.5 percent

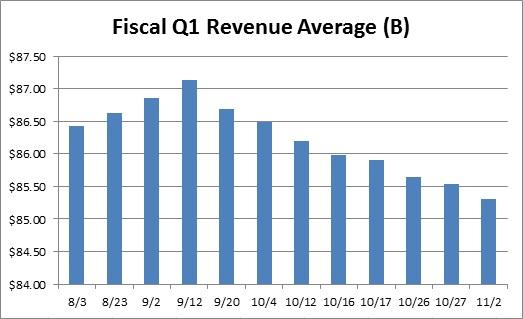

As I have been discussing for almost two months now, analysts had been taking down their estimates for the holiday quarter due to the later than expected launch of the iPhone X. As you can see in the chart below, the average street revenue forecast dipped by more than $1.8 billion between the September iPhone event and today, finishing at $85.31 billion. That puts the midpoint of management's guidance right where it needed to be. Had this guidance been issued two months ago, it would have looked light. Gross margin guidance matched guidance for last year's Q1, which means that any extra costs for this year's phones are being passed on to the consumer at a comparable rate to keep margins flat year over year.

(Source: Yahoo! Finance analyst estimates page)

(Source: Yahoo! Finance analyst estimates page)At the end of the September fiscal year, the balance sheet had more than $268.8 billion of cash and investments, along with $115.7 billion of commercial paper and debt. In the 12-month period, cash flow from operations was $63.6 billion, while Apple spent $12.5 billion on capex, $12.8 billion for dividends, and $32.9 billion for share repurchases. During the fiscal 2017 year, the company was able to reduce its outstanding share count by 210 million shares to 5.126 billion. That number is likely to head even lower if Apple can repatriate foreign funds at a low rate, one of the main reasons why a key Senator says that the new tax plan is a $2 trillion handout to big corporations. Capital returns will continue to flow generously, and perhaps Apple could make some more acquisitions to strengthen its ecosystem.

In the end, Apple was fairly treated by the market for its blowout, just like we saw last week with other technology giants. Shares have pulled back a few dollars from their after-hours high, but still are up 2% on the positive report. The headline numbers will grab your attention, even if some of the details don't. The future of Apple is certainly bright, and if Thursday's news about tax reform actually leads to some changes in policy, Apple is set to be one of the biggest beneficiaries, sending the stock higher in the long run.

No comments: